by T.A. DeFeo

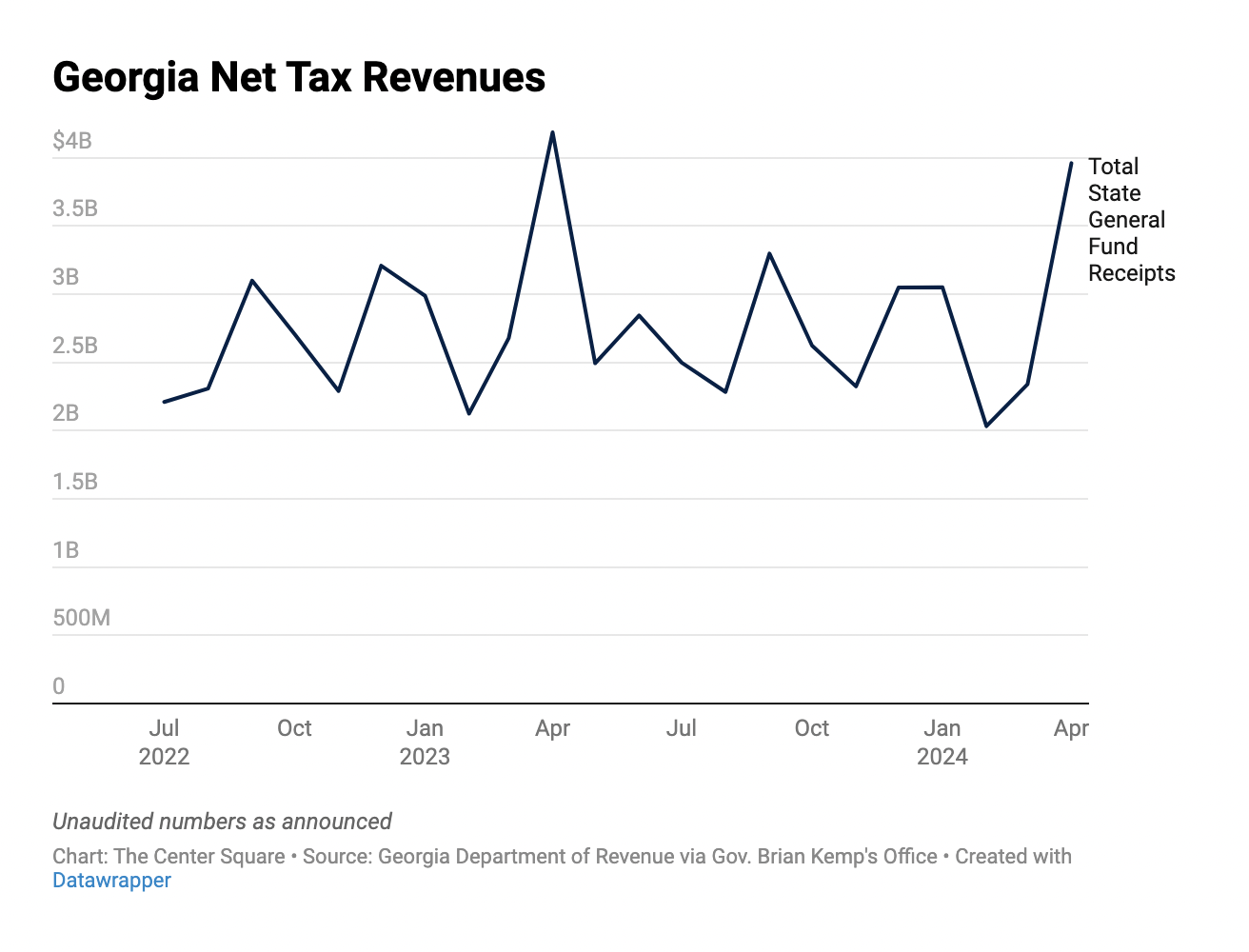

Georgia tax officials collected more than $3.9 billion in April, a decrease of 5.4 percent or $225.7 million from last year.

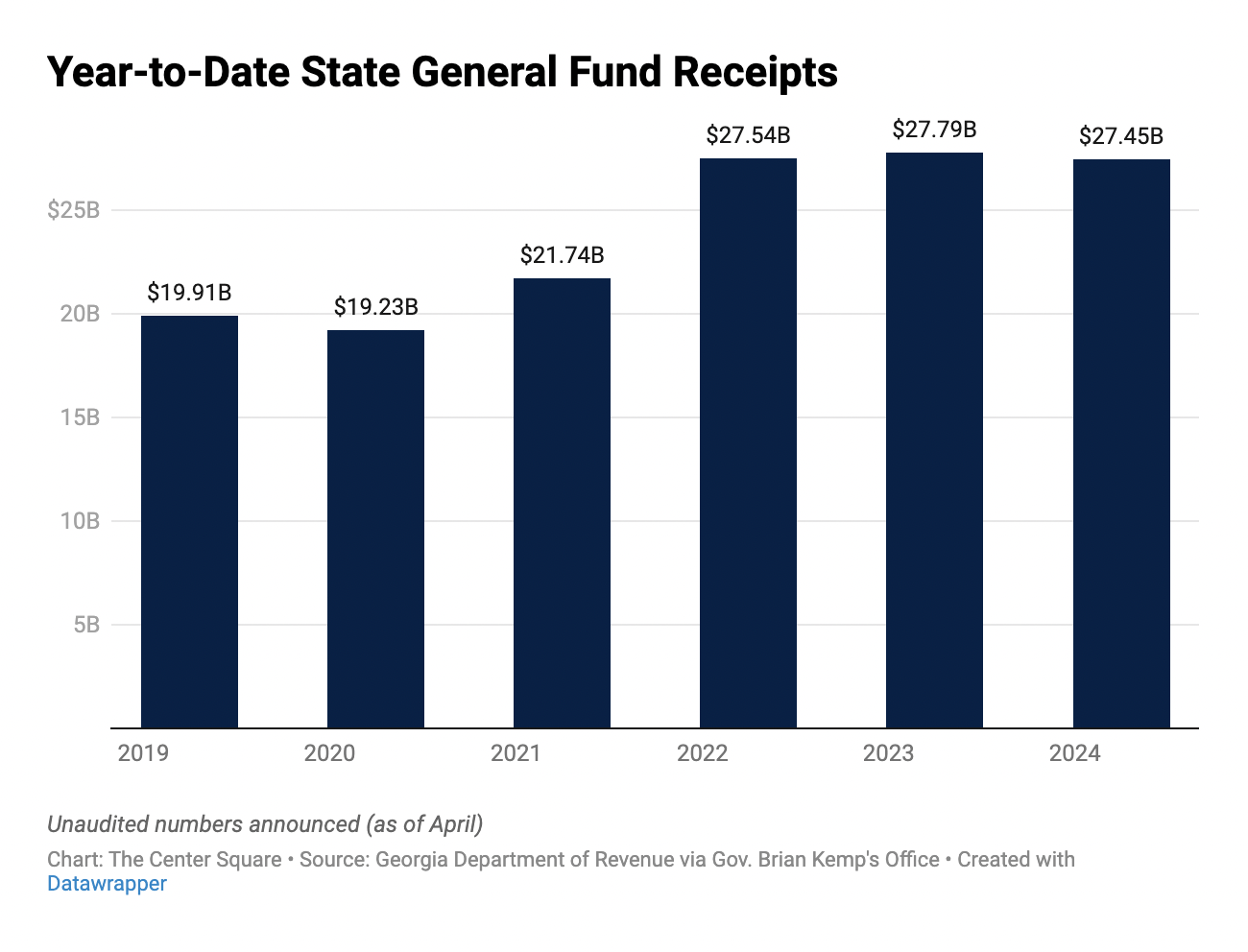

So far this fiscal year, net tax revenue of more than $27.4 billion is down about 1.2 percent or $341.3 million from last year. While fiscal 2024 collections have decreased from fiscal 2023 and fiscal 2022 numbers, they remain higher than they were at the same time in fiscal 2019, fiscal 2020 and fiscal 2021, according to unaudited numbers released at the time.

However, aside from motor fuel tax changes, collections for the 10 months of fiscal 2024 that ended April 30 decreased 4.6 percent from the same period in fiscal 2023. The state’s motor fuel excise tax was suspended until Jan. 10, 2023, and the governor temporarily suspended the tax again in September 2023.

Last month, motor fuel tax collections surpassed $195.4 million, up from nearly $192.4 million in April 2023, numbers show.

Year-to-date individual income tax collections are down about 6.6 percent, while corporate income tax collections are down about 8.6 percent.

The state is poised to rely less on income tax collections moving forward, as last month, Republican Gov. Brian Kemp signed House Bill 1015 to speed up a decrease in the state’s personal income tax rate.

The measure lowered the individual income tax rate from 5.49 percent to 5.39 percent for the tax years starting Jan. 1, 2024. It decreases the rate by 0.1 percent annually starting Jan. 1, 2025, until it reaches 4.99 percent.

Moving forward, Georgia officials could further lower the rate, and Lt. Governor Burt Jones has said he wants to eliminate the income tax.

– – –

T.A. DeFeo is a contributor at The Center Square.

Governor Brian Kemp” by Governor Brian Kemp. Background Photo “Georgia State Capitol Building” by Warren LeMay.